Putting the money where the heart is?

11 Januari 2019

This monthly letter comes usually out in the middle of the month. I think it is still not too late to wish everyone a Happy and fulfilled 2019, or what is left of it today.

Unpredictable as life is, for some this year may not bring much joy. I just received email from Germany. A friend of mine sadly lost his wife after 45 years of marriage on January 2. He wrote to me from a hospital, where he is treated for colon cancer. ’Happy New Year?’

Obviously no guarantees are given. Coming to think of it, even saying ’Happy Birthday’ can be regarded as ironic, because with every birthday we are one year closer to death.

Especially in the early days of a new year we should keep the head up so that the evil spirits (if any) can see they have not much of a chance to make us miserable and go for someone else instead.

Let us go on in search for the silver lining and be realistic enough to remember then there must be also a cloud somewhere.

Before I risk getting lost talking about things which you know anyway, at this point I want to quickly add that this is just a friendly letter to point out some basics in life and naturally, because written by a real estate bloke, throwing some simple advice in so that maybe reading to the end is worth your while. All based on the assumption that you looked up UbudProperty for a reason today.

Recently I got fun out of a paragraph in Scott Pape’s clever book ’The barefoot investor’. He says: ’Bank managers, financial planners, real estate agents and mortgage brokers are salespeople, not educators. The more you know, the less they get’. Spot on! Just that his book is from 2004. Since we had 15 years of google education and wisdom. It came so far that today we should not try to count the people who have a hand phone with access to oodles of information, it is easier to count the ones who have not. Clearly sooner or later any business which tries to pull a blanket over their client’s eyes will soon be found out and loses. No BS here, no BS from any of us at UbudProperty.

Until the recent years I would not have dared to talk as if I know much useful outside my immediate daily or professional life. There are no letters after my name and I was too busy overseas to read much of the old philosophers or

meditate with Yogis in south India.

However, I have been around the block several times - meaning, that I am in retirement age and have fairly much experienced all I ever wanted to and then some more. Why am I saying so?

Because you, dear Reader, are likely to be over 45 years of age. This is the time in life when most our clients come to Ubud intent of hitting the brake and changing direction and planning to make the best of their days in this great environment. Being on the same page helps in understanding, right?

’Life is what you make it’, they say.

Well, I think this is not entirely true. What if on your next trip at the check-in counter some naughty bacteria is floating into the nose? Heaven beware! But TBC, for example can stay for a long time undetected but may completely stuff up your life later. Do we have a way to control everything around us?

Do we?

Or can we simply trust in God that he will not want this to happen to his precious creation?

Obviously, if there is God, he may not even realize that you or I exist. Same goes for my friend with colon cancer, goes for the people near you, and essentially all others.

Isn’t it quite possible, because He/ She or It is in charge of milliards of galaxies, one can easily be overlooked?

If that is so, then we need to our newly reborn new-years-realism and better take over the driver seat our self. Good things and the opposite just happens, deservedly or not. But steering the wheel whilst looking out for pot holes should eventually bring us onto the happy road. To be proper prepared for cruising this winding road it is advisable to tank up on as much knowledge as we can fill in. The more knowledge there is filled in, the less mistakes we make and also the speedier we can see through issues to decide what we can change or cannot prevent, which sure will reduce stress and anxiety and saves on wasting precious time.

No stress is good for health. More Knowledge and applying it keeps you ahead of others. You know it, everyone else knows, but few tank up very seriously, - some even can’t ...

There is the story of a man named Donald Trump-

You may have heard of him. He is an important man.

When he visited a school to show interest in the system, he spoke to the kids: "I will make this Country great. I will send men to mars, yes and we will even soon land on the sun."

A boy raised his hand: ’Sir, you cannot land on the sun, it is very hot’.

’Yes I know that, but we will do it at night’.

You see, to acquire only a tiny part of available knowledge on physics or say, philosophical issues would need more hours of discovering and learning than are available to the average money earner, let alone trying for an nderstanding of the universe and its origins. We also cannot control the virus and bacteria living in, on and around us, but obviously we can control our level of wanting to understand and our awareness. At times it pays well to sit back and reflect on what we know so already and what we know are the ingredients of a good life.

To me next to health and good relationships, the most important thing is financial security.

Have a guess how many partnerships or marriages fail because of financial problems? This is the number one marriage killer, especially if the problems are not openly discussed. Example :

In the USA 49 out of 100 marriages are breaking up within 10 years. In Russia over 65% and in Germany 41%. (In Bali less than 5%. Reasons are in society, quite complex and here is not the right place for talking this through anyway.

Well, back to from where we started off – if the marriage runs just fine, but we still want this and that? Money is needed

Wanting to stay healthy or fix the illness? Money is needed.

Taking care of your loved ones? Same.

This goes on about almost all else in life. So, in order not to wake up one day and be totally surprised that even the saved money is not of much use any more, why not think on this occasion about what money really is, where it comes from and most of all, can we always trust it will be doing for us what we need it for?

The Japanese once had rice money. The idea did not last, because storage time was limited. There were shells and other nice things for buying something and later coins were being used. Much better, good for storing value long term and out of coins emerged today’s paper- or plastic money.

Unfortunately to accommodate international trade, the world’s money values, 3% printed, 97 % just digital, are until today based on the perceived US Dollar value. In 1971 Richard Nixon ended the backing of the US Dollar by real gold holdings "just temporarily", which still is how it is today. The expression FIAT money is used now, which is Latin, meaning ’let it be done’. If you do not understand the deeper meaning, don’t ask me either.

Plainly spoken, all money has no value, other than that people trust that it will be accepted when they want to pay for something. This always worked, except in times of economic turmoil. My grandmother told me that she remembers times when a single bread cost 20,000 Deutsche Mark, and next day went up by 20% more.

If the US Federal Bank prints more money, then in consequence this monetary increase worldwide in each and every country is again backed by nothing. The actual value of the circulating numerous currencies is decreasing each time by the total value of the printed notes.

Given that today on the internet you find a considerable number of doomsday reports regarding a coming economical crash in the near future, I do not believe that these should be totally ignored as nonsense. Seasoned bankers when asked to predict the future of worldwide economy look worried. The consensus is again: it is not an "if", but a "when". Let’s hope for the best and plan for the worst.

If you look up and learn more about where does money come from and what it really is, you can probably better relate to the old man who went daily to his banks counter and demanded to have his deposited money counted again before his eyes. ’Is it really still there? Thank you, see you tomorrow.’

We may put money in the bank, but if a serious crisis hits, we have no control over its value loss. Even without crisis, we lose out anyway because of inflation.

Global inflation in 2018 was 3.78%. Indonesia did reasonably well with 3.13 %. However, Indonesia’s average inflation rate from 1997 until 2018 was 10%. To be fair, this is not giving a very clear picture because of the all-time high in September 1998 of 82.4 %.

Now, you still want to put considerable Savings in the Bank?

Some really do. Often via Certified Deposits (CD), instead of normal short term savings. For a CD, in exchange for receiving a slightly higher interest rate, you agree that you cannot touch your money for a predetermined amount of time. If you are hesitant to commit, try comparing rates through savings and CD calculators. I do not know where you come from, so we only look at Indonesian CD interest rates. Presently they can be as high as 7.5% for a substantial savings amount, usually a minimum of 100 Mill. IDR. Compare this to the inflation percentage. Just remember to allow for the 20 % Government tax on interest earned, which the bank takes straight off from your account.

Still not bad, really.

If you need to pull your money out before maturity date, it will be paid out to you, pronto. That is not bad either. You just have to allow for a penalty on your earning interest.

How about Gold?

- Warren Buffet says: ’Gold has no place in a modern investment portfolio’.

- The ad’s say: ’If the stock market crashes this is the one investment which does not go belly up’.

I say: ’Have a little’. Maybe Mama is happy to wear something pretty around her neck and in any case, if in the unthinkable event, that everyone around us is getting hungry in a severe global crisis, it should be enough to pay our way out of trouble.

In the second world war, a few ounces saved many families, when fleeing from disaster in Germany and paying for their passage onto the ships, at a time when paper money was used to light cigarettes. Just saying.

You may be thinking ’it is also smart to have a few gold nuggets hidden in the rice jar. The tax man does not know and in case I ever die, the kids don’t lose 40% of their heritage on taxes’. Who can blame you?

Gold is holding its value reasonably well. Should you like the independence from institutions which are holding your savings, read up a bit more on this. The internet is full, but with often contradicting advice until vertigo is setting in.

Stock Market Investment

Now you got me. For most of my life I never earned enough to be able to put more than the value equivalent of a cow, or say 5 goats into the stock market, which I’d liked to keep anyway in case I’d marry one day to the middle east. Therefore, if I would give any advice from my meagre experience, that would be as if expecting a cow to lecture on astrophysics.

However, you and I hear voices. Not the ones which let you end up in a mental facility, but the voices whispering about the marihuana boom in USA, or colossal returns and sky rocketing IT- and Pharma stocks.

All I can gather is, that, when buying ’modern’ stock you can expect over a 5 year investment term about 10% gain annually, if nothing bad happens. Again, take the tax off and think carefully if a possible positive outcome is worth

the risk, unless you play it safe with just a minor portion of your funds or long term on safe stocks.

So it seems that you either purchase reasonably safe stock of large established Companies and sit it out on an average 7% annual return, or you put a wee little bit into exploring the more challenging investment recommendations,

but better just for the fun of it.

I am going later to buy a lottery ticket instead. It’s faster. Similar outcome.

Best-selling author Peter Lynch, also being one of the best performing fund managers over twenty years said: ’Twenty years in this business convinces me that any normal person using the customary 3% of the brain, can pick stocks just as well, if not better than the average Wall Street expert’.

Mutual Funds

MF’s are not as sexy as direct investments, but if you do not like to risk much of your good money from the savings sock, Mutual Funds allow you with only a small amount of money to gain a foothold

in each investment class. By having a stake in all of them you lower your risk. The fund manager can buy the latest model Porsche and very likely you will get a little profit, usually slightly above the

bank interest rates, to keep you in the game.

Bonds

The shortest summary I found to explain bonds reads like this:

When governments and corporations need money to pay for projects, they raise capital by issuing bonds, which are debt securities that they must pay back to lenders in a specific time period at an agreed rate of interest. Bonds are generally considered a more conservative asset class than stocks, which historically have been more volatile. Government bonds are widely believed to be a safer bet than corporate bonds, but they also pay lower rates of interest to bond investors.

As with any investment, risk does accompany any bond purchase – even government debt. For example, Argentina defaulted twice on its debt obligations in the first few decades of this century and many times last century. Over the long term, stocks do better. Since 1926, large stocks have returned an average of 9 % per year; long-term government bonds have returned between 5% and 6%, according to investment researcher Morningstar.

Cryptocurrencies

I truly love the underlying idea - Stuff the banking system.

The most famous cryptocurrency, or digital currency, is Bitcoin. It uses rules of cryptography for regulation and generation of units of currency. Bitcoin is the first and most valuable cryptocurrency and is commonly called a de centralized digital currency. Bitcoins are completely virtual coins designed to be ’self-contained’ for their value, with no need for banks to move and store the money. It is

fast and easy to transfer their value.

If you enjoy rollercoaster rides, jump on. However, no attendant is there to tell you when to jump on best. I did tinkle a bit and gave up after some ups and downs. Made a meagre profit which was

hardly worth the value of the soap needed to get the sweat stains out of the shirt.

Should’ve bought when it was $ 2.- per bitcoin. Should’ve / would’ve / could’ve.

Who wants to drive a Lambhorgini in Ubud anyway? Furthermore, what most of us are willing to risk in crypto investment today, even when going well, it is not going to change our lifestyle much anymore.

Best, wait and see what is left after some other more adult investing and then maybe …

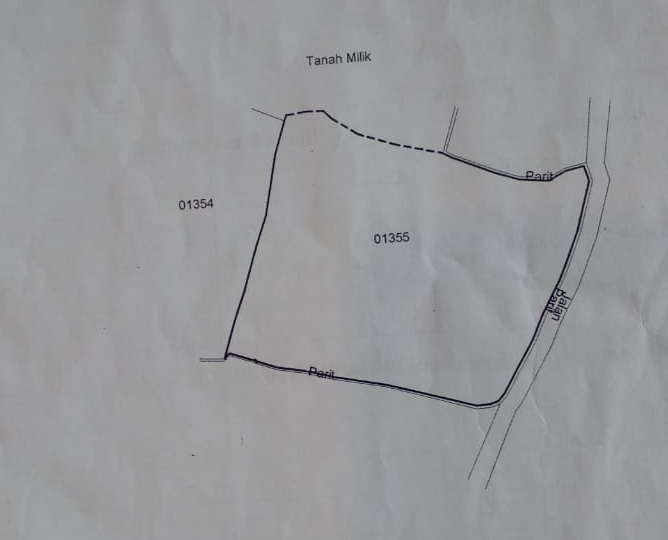

Land and House

Earlier I said that I will try not to talk about property, you remember, yes ?

Problem is, in any list of investment options you also find property being mentioned. Would you want me to cut out investing into land or houses, or should we complete the overview and have a quick

glimpse about how property works as investment? To keep in line with my intention, I will not only talk about the monetary aspects of having property.

Here in Ubud there is much more to it, related to life’s goodness. Let’s bundle this up then:

You see, today I am here for almost 20 years and I never wear pink colored glasses. So I can see both sides, the good and the other reasonably well.

You would quick see through any attempt to fool you anyway if anyone tells you Ubud is the one and only paradise on earth. There are others, for sure. But where?

In my book Bali/Ubud is great.

The flip side is, for example, that from the intake of CO2 during a bike ride from Ubud to Denpasar you could kill a mid-sized rat family. Or after a decent rainfall in Jalan Andong you’d be able to collect enough plastic bags to cover the needs of a country like Macedonia for 2 years.

Then there are the congested roads, holes in the walkways, (probably to keep the ambulances in business), the need to say ’Thank you’ to every third person you meet, because you don’t need a

taxi, - but now I am already running out of the serious horrors.

There must be a reason, that after nearly 15 years as real estate agency, we still today greet plenty of people who come for their first time to our office, wanting to settle and ask for advice.

They are not wide-eyed leftovers from the 70’s but people like you and me, many already have been traveling the world in search for their own paradise.

Solid proof, that we established expats are not just isolated nut cases.

They are even coming from places like Hawaii, would you believe it. Well, here our lower cost of living may be a main factor.

The increasing interest in Ubud’s life options is also forcing our office to expand. We are presently advertising several open positions. If you know of an honest and smart local who speaks and writes

perfect English, and you believe in him/her, please send them in and I buy you lunch. Promise.

Here is the team:

I am also proud to tell you that thanks to the many clients who trusted us, we are in the position to support hundreds of local school children so that they can keep going to school, when their

parents couldn’t keep up with fees any more. Great feeling for everyone. Enough of beating the drum.

By the way, apparently but not totally unconnected, - what do you, can anyone, ideally expect from life? Nothing. You should not expect anything. There is certainly no entitlement whatsoever.

You likely have found out that life is not something to expect something from, sometimes it will just throw at you the least expected thing and you will somehow need to adjust yourself to it. It would be harder to adjust to it if you had expectations of what it would be.

However, it is a very different thing to plan for your life. Plan how best to find fulfillment and enjoyment, plan a family, then plan where to live and where you want to retire. If you planned your life and work and then worked you plan, you should have made the savings which allow you to move you towards your dreams. Yes, pay health insurance, take care of the kid’s education, travel as much as budget allows, just make sure there is enough money to take care of a nice home to stay if times change and a steady good life is what is making you happy then.

Last week in front of Casa Luna in Ubud’s main street, a tall man put his hand on my shoulder. ’Are you a local?’ He sure meant if I am living here, which I said I do. He explained he is from Czechoslovakia on his first visit to Ubud and after just a few day’s likes life here and people very much. ’Where is the local waterhole for expats?’ So I told him he has to find out himself, which groups may be matching with him, where to try and look and he understood. It turned out that he now lives in Sydney. After much travel, including Malaysia, Thailand and the Philippines he says he is genuinely moved by the attitude of Balinese people and feels ’real good’. In Sydney I live 500 m from the ocean and never go. Also here the coast is not my choice. Ubud could be it.

’You think I should sell my home, take about 500 grand and come here with the wife?’ he asked.

Not knowing much about them after just a few minutes talk on the street, I gave Mr Joseph only vague advice. "The key is to follow what your budget allows, what your collected knowledge and your

stomach tell you. If it turns out you don’t like it here enough, at present you cannot expect to ’buy, flip and go back after six months with 20% gain, as it happened before. If this is part of your plan,

don’t come". Yesterday he came to our office to arrange for house inspections. Nice guy, you may meet him later.

What else is there to wish for? Live on your wonderful place, create the tropical garden, rent out when you are going away and you covered all there is to find the good life. After all, you cannot take money with you when you go. The Egyptians tried it. They got robbed.

Buying a residential property here takes proper care of your savings. You can combine an amazing life style with the certainty of a neat capital gain long term. In any case, keep your receipts from land or house purchase for the kids. In 20 years they will look at it and laugh about the tiny amount you paid for your property in Bali.

Naturally, when owning your home here, there is also the option to make a modest passive income from renting. Why do I say modest? Because in comparison to exciting stock market gains, or buying

into Hong Kong or London, for the time being, you need to reduce expectations from passive income.

An example: Right now there is a 20-year villa-lease for sale, Price USD 180.000.- . A real pretty, absolutely quiet place, newly built, right near Ubud’s attractions. It rents out at 20 Mill. Rp/month, which gives a return of about 7.5 % p.a. Maybe not spectacular, but a solid passive income and if someone choses so, also perfect to live in. There are dozens of other options, such as picking up such a low investment lease contract and sell with profit after several years living in this villa. However, the remaining lease period should be still attractive enough for the new owner. Then there is the issue of how to smartly arrange for a lease extension, which adds value without paying any cent…

There is much to find out and talk about. Truly interesting options, of which some may be just right for you. Check out www/ubudproperty.com, call or come in.

No obligation. No charge, very likely however, a pleasant experience.

I am leaving now because the coffee aroma from the kitchen is passing by.

Makes me thinking that sometimes the most enjoyable and wonderful things come from being aware of even very small blessings. Life is a beautiful mystery packed with emotions, particularly when your awareness happens to receive so heavy input as is given here around Ubud.

Also the fish in the pond need feeding and the maid put the chairs out again after the rain… ’coffee time!’

Good bye and see you then.

Warm regards, Ray