Paying Property tax in Bali

27 Oktober 2015

Paying Property tax in Bali… do I really have to?

In our chronicles of experiences with clients in our office, this one really needs some attention. It’s one that has a lot of mystical stories around itself, or is the always ‘forgotten’ duty that only matters when it’s too late.

Especially as a foreigner living in Bali, you may not be aware of the different tax systems that are in place. You may have your ideas on how the islands are run, and somehow paying taxes never really crossed you mind. Or, what also happens is that people think that it’s ‘not really necessary’ as ‘they will never know’. However we find that in our office the clients that we educate on this matter are simply not aware of the taxation rules that apply when buying and selling a property. Another tax they are not aware of is the annual property tax.

Now let’s dive a bit deeper into this:

When you buy or sell a property in Bali, there is a 10% tax that needs to be paid to the government. Usually this tax is shared 50/50 leaving the buyer and seller with each 5% of tax to pay.

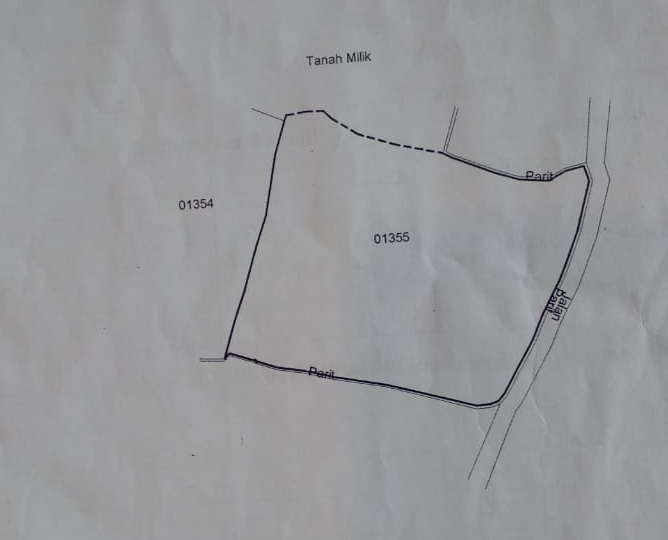

When you own a property, whether it’s lease or freehold, you need to pay annual taxes. Taxes are to be paid at the government office and it’s your responsibility they get paid. This tax is usually very low, and depends on the size and location of your land and the size of any buildings on the land. An average 300sqm property can be obliged to pay 250.000rp (USD 25) per year where as a 4000sqm land with a building of 1058 sqm can pay up to 7,500,000 rp (750) per year. Although these are relative low amounts of money, it is essential you pay this every year, as when you want to resell your property you will need the confirmation from the government that you have indeed paid this tax.

When you rent out your property you also need to pay an income tax on all bookings/ transactions regardless unless you are not an Indonesian citizen do not have an Indonesian tax identity, or even not living in Indonesia for more than 180 days.

This rental income tax is a final income tax, and not related to regular personal income tax (if you are also working and receiving income in Indonesia). The tax system here is self assessment system, meaning you are responsible to report and pay your own tax

These are 3 of the most encountered taxes and we hope this will give you as an existing home owner or a future property owner an idea of what you can expect. As in any country, we advice that you get a full understanding of the tax procedures, and hope you realize that there are consequences in not paying your taxes. Therefore the answer is: yes, you need to pay your (property) tax!