The Safest Investment

16 Januari 2017

Although 2017 is already slightly used up, let me still say this: You probably heard often enough "Happy New Year!" so you won’t get that from me too, as you are already well equipped with many hopefully well working wishes. What I do hope you will enjoy is a healthy and prosperous year with plenty on the plus side.

Well’ get to that in a minute.

Since from all areas in Bali you have chosen Ubud to focus on, we should start the New Year on a happy note and look at all the good things to see and experience in and around Ubud. However, a promise is a promise, because in the last newsletter I said I will finish the review of some mainstream investment options by looking into investing into Ubud’s properties. Therefore there will be not much on culture and happenings this time. Maybe next month.

Right now in order to clear our conscience a bit and to have some ammunition on hand should anyone accuse you: “you heartless investors take the basis for agricultural income away from the Balinese”, here is my short story:

I live now 8 years on a leased block of land in Tegallalang. Very pretty. I have another 22 years to go on the contract and do believe that by then, I am ready to relocate to a more urban situation. However, the beauty and peace which only your own patch of land can provide, is immensely adding to the quality of life and considering that the coffin does not have a luggage carrier I am happy with the leasing option anyway.

Now – the land owner, Pak Wayan

and his wife work full time on my place in gardening and house maintenance. We go on well and support each other with more than just exchanging labor against salary.

They leased their land because neither they, nor their 18-year old son want to work the rice paddy any more. Bapak has arthritis, which does not go well with stomping all day through the cold mud. They said that getting a good education for the son is guaranteeing their long-term income. That is what they aim for.

Now, remember the lunchtimes, when the schools open the gates for hundreds of bright kids, pouring out on the street everywhere over Bali? A merry atmosphere and happiness on first sight. Underlying though is the fact that each of them faces brutally tough competition when it comes so finding work in Bali later.

Should we recommend they stay home and bend over to attend to the rice, producing a meager income, which will not even sustain them, let alone taking care of their old parents? I bet you won’t find many such kids being exited about the rice farmer option if asking around.

Well then, a) leaving the land to overgrow with weeds? After all land is doubling in value every 7 to 10 years. b) Taking the land certificate to the bank for a loan to live off? Or c) calling more low cost labor from Java or Lombok to keep rice production going? Anyone has a better idea? I am truly blank…

If we think that through, it is not such a bad thing to purchase land freehold, where appropriate, or lease and therefore enable local parents to give their kids a modern education. Later on the land there will be work opportunities for the new generation and also local businesses will thrive because of building and maintenance needs. Bali kids have then opportunities for their future.

Let’s be realistic - 100 years ago Bali must have been sheer paradise. Since 1930 for several decades, the secret tip amongst backpackers, artists and bohemians was "have to go to Ubud in Bali”. Today, you know it, we are reaching breaking point and there is not even enough affordable accommodation for the Tourist Minister’s plan for increasing visitor numbers drastically again.

So, what can we do to stop further development? To keep the traditions and spirit for which we came to here alive? Do we try to roll the millstone back up the mountain? At present there is not even an indication of useful practice by the Goverment to stop the urban spreading. A famous American Story book Author, Jack London, wrote once : “We are now in Year 2030. The world is dangerously overpopulated with over on milliard humans…”. What an innocent view at that time ! Today we count 7.5 Milliard and every year the population of a Country like Germany (about 80 Million) is adding to that.

Ok, we all know, there is precious little individuals can do to bring change on a large scale, other than help cleaning up around us and spreading the advice not to burden nature any further.

Therefore I think we have no reason to feel guilty when someone says: "you should be leaving everything as it always was . . . " I like nature, kindness, culture, peace and freedom, as much as any person, however, having our feet firmly on the ground, we also need to take care of our future, other’s welfare and our assets to make sure that economical and political/social turmoil does not blow anyone away.

That leads us to the conclusion of last month’s analyzing the various available investments. Get yourself a good life and passive income from property investment. Be safe and become prosperous!

Here is what a man said of whom you probably have heard:

“Real estate cannot be lost or stolen, nor can it be carried away. Purchased with common sense, paid for in full, and managed with reasonable care, it is about the safest investment in the world.” ~ Franklin D. Roosevelt

Everyone has his very own personal view, capital means and reasons to purchase property. Surely some of the following thoughts have been your own already –

- Property is the most tangible and direct way of watching your investment grow.

- Unlike shares on the stock exchange, you do not need to monitor your property all the time.

- The value of property does not plummet to the level to which shares on the stock exchange may fall.

- The value of your property can increase with some care and attention given, particularly in an environment with low cost labor. If you renovated the building or gave it a bit of facelift, that will increase its value so that when you sell, you make a good profit from the initial investment.

- Remember to buy in a slow market and sell in a fast market in order to make money. Between November and March, as in fact the entire rainy season here are good times to be making acquisitions and if you can, avoid selling your property during this period.

One of the biggest reasons people buy properties is the pride of saying they own something. Even if it is a little block of 2 are or a simple house or villa, it is yours and you can do with it as you please, and for that, a person should be proud, as ownership is an accomplishment.

However, this applies to property even in downtown of less attractive cities. We are talking about Bali. I guess we don’t have to try hard to search for differences.

Now outright owning property in Indonesia is only for Indonesians, we know that. This is why increasingly foreign investors take the safe and legal option to lease long term.

While stories of quick flips— buying a home, renovating it, and reselling at a much higher price—dominate TV reality shows, renting is the true core of real estate investing. That’s because historically there has been very little real price appreciation in houses. Renting generates a steady monthly paycheck, like a classic dividend-paying utility stock. Any price appreciation is a bonus. On an island with a limited possibility to add on land, eventually capital gain comes automatically, for example in the case you want to sell your lease on again.

But investing in a rental home isn’t like buying a low-cost index fund. Choosing the right property, maintaining it, dealing with tenants—all that takes work. Think about whether you’re prepared to put in the time. Are you happy to handle after-hours calls? What if your tenant doesn’t pay rent?

There is no need to worry. Where there is a challenge, sure there are solution providers. As landlord you select a reputable property management agent and just wait for their monthly report and the rent to come in – against a fee, which is humble when compared with the value of your time or effort. UbudProperty is constantly accepting more villas for management, as the Company is confident to handle all related issues professionally and with well respected reputation.

Quick sidestepping to the agent’s qualities: “Carpet dealers, second hand car salesmen, real estate agents, - same, same” is a frequent opinion. There sure must be a reason for that. However, in a locally confined market, anyone not adhering to business ethics and honesty is destined for doom. Ask around, find where several opinions do overlap and trust that agent. Chances are you selected well.

As we are this time focusing on leasing property– here are the basics which you need to understand; you may even want to get additional legal advice from a good lawyer or a Notary:

About a long term lease contract - Although the land title is not under your, the foreigner’s name and remains under the ownership of the original owner, the land can be rented for an initial period of around 25 years and can then be extended up to a period of 70 (80) years, depending on the number of years of the first lease agreement. After the lease begins, the owner’s title of Hak Milik (Right to Own) will be legally transferred to the foreigner under the Hak Pakai title (Right to Use).

It is wise to already agree in the initial lease the amount for the extension(s), tied to commodities like rice price, gold, etc. (E.g. 1 kg rice cost in 2017 Rp 10.000; if in 25 years the price for 1 kilo would be Rp. 40.000, then the lease would increase by that same percentage).

Under the lease contract the property is able to be sub-leased (rented out to other people). This is how many of us expats turn a leasehold property into a lucrative investment and source of passive income. (Not to mention the benefit of having a holiday home at zero extra expense).

For most investors, the beauty of a lease is that their focus is immediate cash flow and a passive income, allowing freedom from the burden of watching market conditions as the actual value of the property is of no real concern. In a low market there will be an increased number of long-term renters, and in a high market when everyone is purchasing, there is still the benefit of short-term holiday rentals. There is decent money to be made through holiday or long-term rentals, however, be advised to apply for the necessary licenses and allow in your calculation for tax. Nonresident individuals’ rental income is subject to withholding tax at 20%. The fees for a homestay license are reasonable and you find easily agents doing the paperwork for you, same for taxation.

If the leasehold is not renewed, once it expires, all rights go back to the original owner and it becomes a freehold Hak Milik property again.

This short letter to our friends is not meant to replace sound legal and in depth advice, such as on the most common method for a foreigner to acquire and control land and building in Indonesia, which is a combination of the lease agreement and a first registered mortgage over the property, together with various ancillary documents. This security structure is a system of contractual agreements between the foreign investor and the Hak Milik land owner (sometimes also a business partner of the foreign investor), which grants leasehold occupation and mortgage security rights to the foreigner over the property for the terms of the lease and mortgage. If you want to explore more of this, you are welcome to email our in house Legal Department with your specific question (wulan@ubudproperty.com), or for your independence, you see another reputable professional.

Finally, when buying property to rent out, you must consider the yield that the property will generate. To calculate the yield, divide the expected net annual rent by the purchase price of the lease per year and multiply by 100 to give you a percentage.

Over time you would experience an even better yield, as Ubud’s infrastructure and the town’s popularity are increasing drastically. You may have heard, there will be soon two international hospitals being built here. The key is getting into the market before too many realize the potential.

A bit of an insider’s tip about one of the best investments at amazingly low entry cost : check out Dusun Ubud (www.dusunubud.com) . Perfect location, modern, tranquil, some terms still negotiable.

Closing on a less serious note for any Ubud fan who still can fit a scarf around the belly. There is besides our team also more traditional support available –

Built in the 10th century, the Tirta Empul water springs in Tegallalang that feed the three fountain complexes, are locally believed to have been created by the god Indra. Each fountain complex has a special religious use. One for spiritual purification, another to cleanse from evil and the last is said to be an antidote for poison. Well then, you can celebrate your rental income at Naughty Nuri’s and if one of the 11 beers was not good any more, you know now where to go…

Hoping to see you next month – hati hati and to your wealth…

Thanks for staying with us and kind regards,

Ramon Genz

Sr. Adviser / UbudProperty

FEATURE LISTINGS

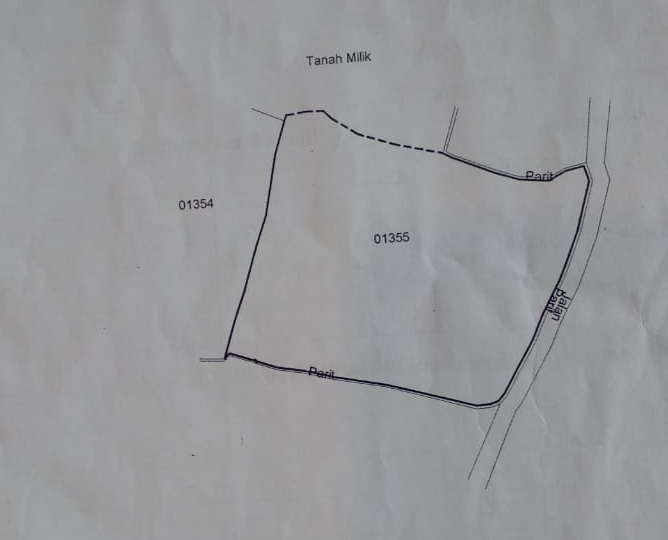

U.635

- 3,379 Sqm

Maybe among the last ones: Land for development of a villa complex near Ubud. More Detail

IDR 9.799.100.000